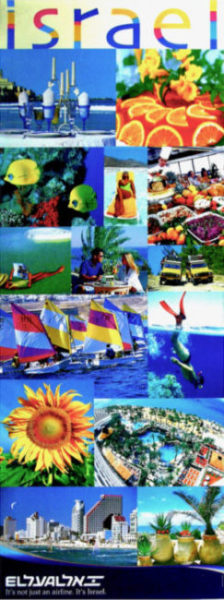

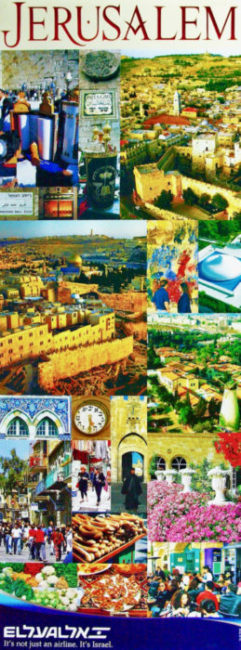

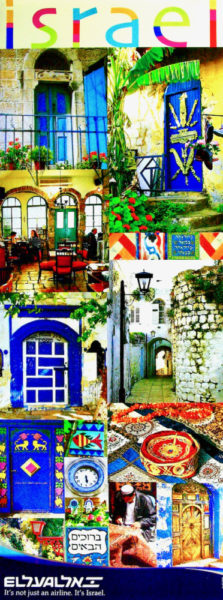

(All images in this chapter courtesy EL AL, unless otherwise noted).

In January 2005, shortly after ownership by Knafaim Holdings in EL AL rose to a controlling position of about 40% of EL AL’s shares of stock, the airline’s shareholders completed the privatization process by appointing a new board of directors, with Professor Israel (‘Izzy’) Borovich as Chairman and his sister-in-law Tamar (‘Tami’) Mozes-Borovitz as Vice Chairman.

Two months later the new board appointed Haim Romano as President and CEO. Romano had previously been deputy chief executive of Partner (Orange), a major Israeli-based telecommunications company, and before that he served 22 years in the Israel Defense Forces, retiring with the rank of colonel.

Five-Year Strategic Plan

In September 2005 EL AL’s management adopted a five-year strategic plan called ‘EL AL 2010’. Chairman Borovich stated, “EL AL’s vision is to be the preferred choice for air travel to and from Israel, with the finest passenger service and uncompromising results for our customers, employees and stockholders. To accomplish this, the new strategic plan emphasizes acquisitions of new aircraft, substantial investments in passenger service and comfort, and expansion of cargo, maintenance and tourism marketing worldwide”.

— New Aircraft

As part of its five-year strategic plan, EL AL embarked on a significant fleet renewal and expansion. In summer 2007, it purchased for $250 million two additional Boeing 777-200ER (Extended Range) twin-engine jets (4X-ECE and ECF), with a range of some 8,850mi (14,250km), ideal for the longest routes to North America and the Far East. Each of these twin-aisle aircraft was equipped with 279 seats: 12 first, 35 ‘Platinum’ (business), and 232 economy.

The two new 777s were respectively called Sderot and Kiryat Shmona. These names stir deep emotions because Sderot is a frontier city in the Israeli Negev beset by rockets fired from Gaza by Hamas military, while Kiryat Shmona is a frontier city in the Galilee near Lebanon that was particularly targeted during summer 2006 by rockets fired from Hezbollah military based in Lebanon.

(Marvin G Goldman (‘MG’) photo)

To fulfill additional immediate aircraft needs for longer routes, while meeting its budget, EL AL resorted to acquiring aircraft previously operated by other airlines. It leased three extended range wide body 767-300s during 2004-2006 (4X-EAJ, EAP and EAR); and acquired two more 747-400 passenger aircraft, one in 2005 under a short lease (4X-ELS) and one purchased from Singapore Airlines in 2008 (4X-ELE).

These acquisitions allowed EL AL to phase out completely its oldest passenger aircraft type – the early model ‘200’ of the 747 jumbo jet. The last 747-200 passenger type left the fleet in 2009.

Longer term, EL AL looked into the possible acquisition of new long-haul aircraft. Management followed the development of Boeing’s newest aircraft model – the technologically advanced and efficient long-haul 787 ‘Dreamliner’, which was entering the test flight phase. However, the airline decided to defer a decision on ordering 787s, and instead contracted with Boeing in 2008 to purchase four additional 777-200s, for delivery in 2012-2013, with an option to convert to larger 777-300s.

For shorter routes, mainly to Europe, EL AL acquired seven additional single-aisle 737-800 New Generation aircraft during 2005-2009. These included three purchased new (4X-EKH/J/L), two leased new (4X-EKF/S), and two leased and previously operated by others (4X-EKO/P).

— A New Service Experience (Five-Year Strategic Plan).

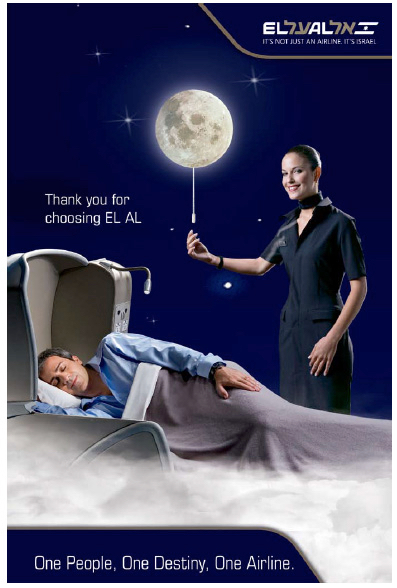

As a privatized entity, and in its five year ‘2010’ strategic plan, EL AL understood that the key to future success is to provide passengers a total pleasurable travel experience—before, during and after the flight. This builds loyalty so customers will want to return again and again. As stated by President Haim Romano, “Flyers know about EL AL’s reputation for security and safety, but we want travelers also to think of EL AL as offering the best flight service and comfort, and we will do everything in our power to make the EL AL experience the best possible one for passengers in every class of service”.

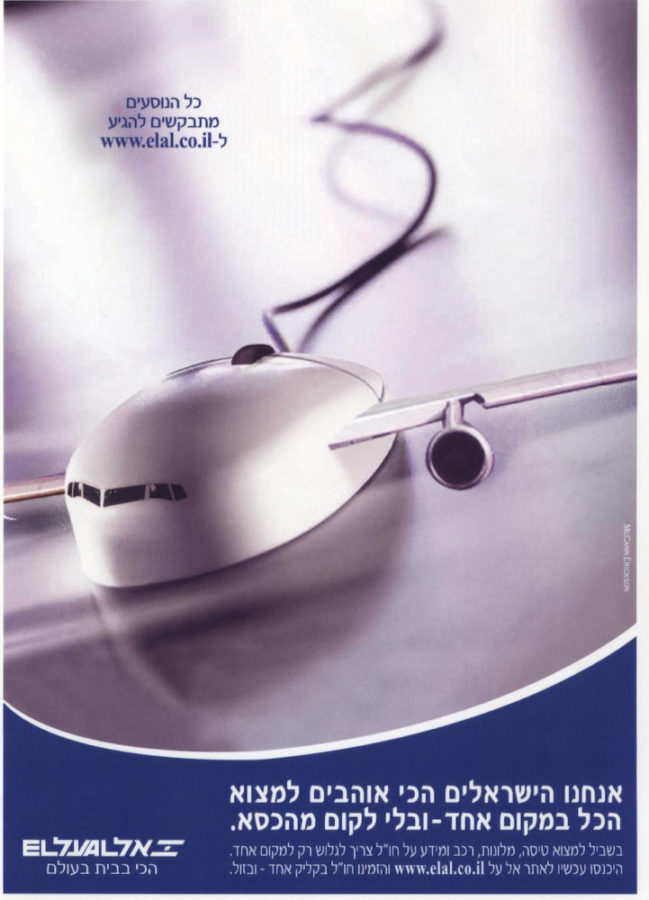

—- Pre-flight

Website. At the 2005 start of EL AL’s five-year strategic plan, over 95% of EL AL’s airline tickets were sold through travel agents and marketers of tourism packages. The less than 5% remainder were sold directly by EL AL sales offices and through its internet website that was relatively primitive compared to later expanded versions. Recognizing the airline industry trend to encourage more efficient direct sales, EL AL launched a new upgraded website in 2006, improving self-service for customers on the internet. In addition to ticket purchasing, the new website allowed online check-in, and seat and meal selection, in all classes of service, as well as the ability to make changes online. More language choices were added. In 2009, the website initiated the choice of purchasing duty-free items online (including the option of paying with frequent flyer points), thereby ensuring the products would be delivered onboard the passenger’s flight. As a result, the number of visitors to EL AL’s website surged during the 2005-2009 period.

Centralized Call Center; SMS. To handle all customer inquiries worldwide and provide faster solutions for any problem, EL AL opened in March 2006 a centralized 24-hour call center at its head office at Ben-Gurion Airport. A call to a local EL AL number in any country is automatically routed to this center. The airline also introduced SMS (Short Message Service), enabling customers to access flight, check-in and luggage information via simple cellphone text messages.

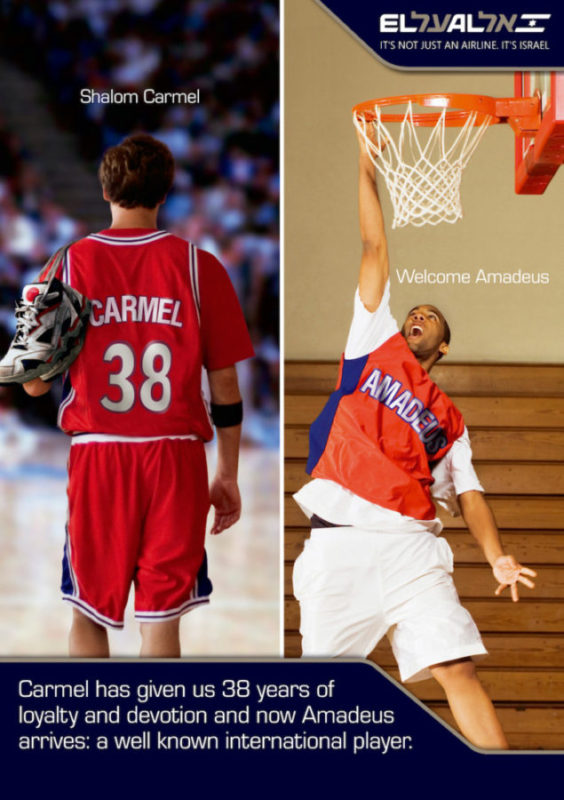

Amadeus. In April 2008 EL AL replaced its Carmel computer reservations system with the more technologically advanced Amadeus system. By using Amadeus’ travel technology, EL AL significantly enhanced the reservation services provided to its customers, whether through the airline’s website or other direct sales or by travel agents, and the airline gained flexibility and ease in adapting its pricing and marketing to changing travel conditions.

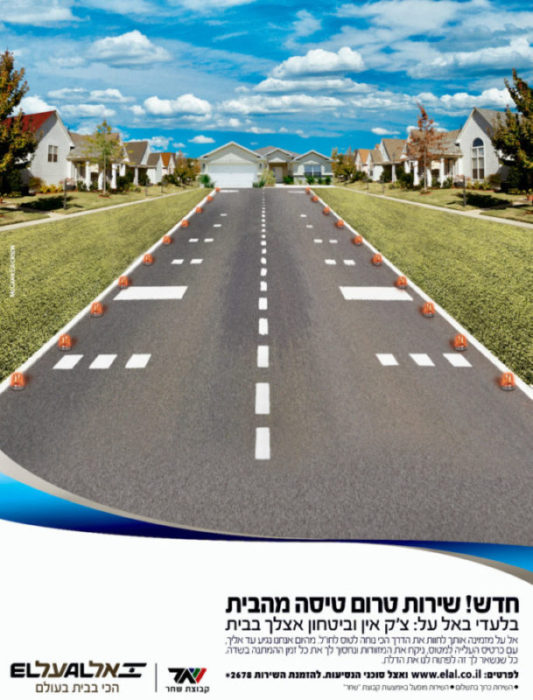

Early Check-in Option. During this period EL AL also created the option of early check-in right in the traveler’s own location in Israel, at first available in certain areas, from 24 to six hours before departure time. For a small fee, a ground attendant and security checker perform the full check-in process at home or office, issuing boarding passes and transferring baggage to Ben-Gurion Airport. At the airport, passengers then proceed directly to passport control.

At the Airport. At EL AL’s home base, Ben-Gurion Airport, Terminal 3 opened in November 2004 as the centerpiece of a $1 billion improvement project. Located 3km (1.8mi) west of the original main terminal, it is four times the size. An Israel Railways line connects Terminal 3 with many cities, including downtown Tel Aviv that can be reached in 12 minutes. EL AL immediately acquired the largest presence of any airline at Ben-Gurion, with extensive check-in areas, including self-service kiosks, dedicated first and business class counters, and the entire use of Concourse D.

At Ben-Gurion Airport’s new Terminal 3 EL AL designed a new, expanded, King David Club lounge for its premium and most frequent passengers, and in September 2007 it opened a new modern King David Club lounge at New York JFK Airport. These were in addition to its airport lounges at London Heathrow, and Paris Charles de Gaulle (expanded and renovated in 2006). Each reflects a commitment to provide luxurious surroundings that further contribute to a memorable flight experience, including a business communications center, food and drinks from a varied menu at Ben-Gurion and JFK, and a full spa and showers at Ben-Gurion. King David Club members also enjoy access to lounges at certain other airports.

(Sivan Farag photo)

—- In-flight Comfort and Service

Upgraded Aircraft Seats and Interiors. Starting with the Boeing 777s acquired in 2007, EL AL installed in the premium classes (First and Platinum Business) luxurious seats, offering great comfort and adjustable to many different sitting and sleeping positions, with individual lighting, personal storage compartments and privacy dividers. The fully flat seats in First featured a 77in (1.96m) pitch (the distance between rows). The seats in Platinum Business recline to a 170-degree flat bed position with a 62in (1.58m) pitch. Economy class was also fitted with improved ergonomic seats with adjustable headrests and a roomier cabin than most of the competition.

The new 777 cabins introduced LED (Light Emitting Diode) ‘mood lighting’ that adjusts the degree and color of illumination to coordinate with the actual time of day and with activity such as mealtimes, sleeping and relaxation. The entire interior offered a warm and pleasant travel environment.

Every seat in every class on the new 777s included personal laptop computer connections and featured a wide-screen personal digital entertainment system with VOD (Video on Demand). Passengers could select their entertainment by both touch-screen and remote control. Choices included a large selection of in-flight programs, music, films and television shows, games, information on EL AL and duty-free products and specials, and customer satisfaction surveys allowing immediate feedback.

The above enhanced seats and in-flight entertainment were subsequently installed in all of EL AL’s 747-400s and earlier 777s, with full completion in 2009. Also, during 2005 to 2007, new Platinum Business class seats were installed on EL AL’s 737-800s and 767s, with those on the extended range 767s having a 60in (1.5m) pitch and nearly flat beds.

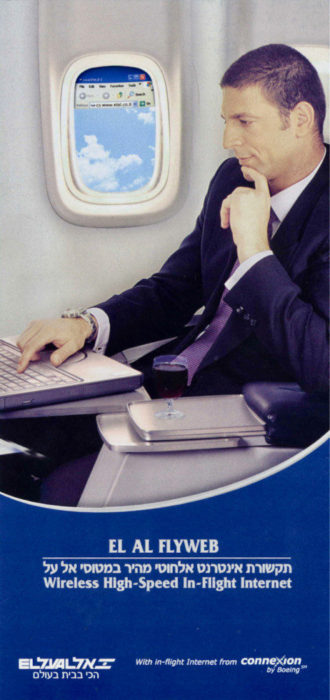

New Internet Connectivity. In September 2005 EL AL became one of the first five airlines in the world to offer fast internet service in the air. Through an arrangement with ‘Connexion by Boeing’, passengers on EL AL’s 747-400s and 777s could connect to wireless high-speed internet, called ‘EL AL FLYWEB’. In 2006, EL AL started providing passengers on certain aircraft the opportunity to make telephone calls from their seat through Iridum global satellite connections, at attractive prices while inflight anywhere in the world.

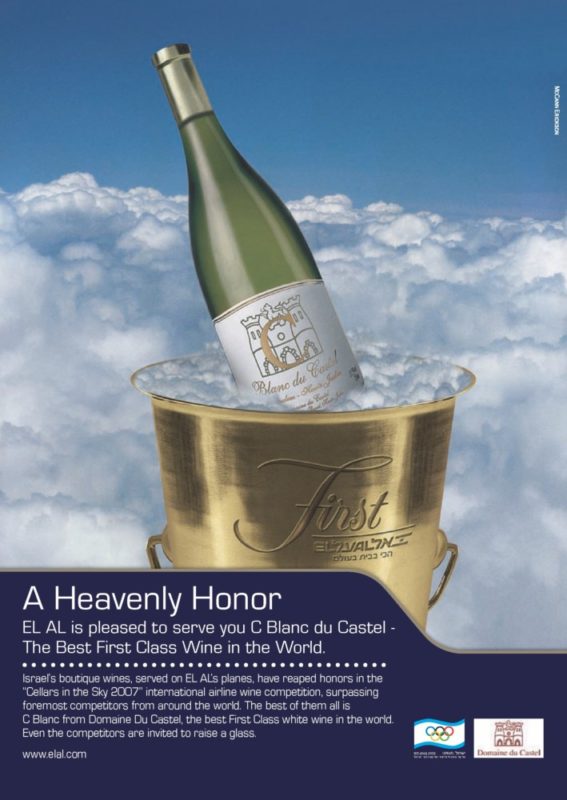

Meal Service Upgraded. In all classes of service, EL AL placed greater emphasis on healthful foods and more choices. Premium classes continued to enjoy a wide selection of freshly prepared gourmet meals and fine wines. As always, all food service is kosher, that is, prepared in accordance with Jewish dietary laws. Accordingly, there is a separation of meat and dairy products, with separate galleys, dishes and utensils.

Flight attendants. EL AL continued to implement a rigorous selection process and an intensive training course. This includes a detailed understanding of how to provide excellence in service, and thorough instruction in safety, health and security requirements. In all, EL AL took the necessary steps to live up to its goal of making every flight feel like being at ‘Home Away From Home’, a motto it adopted when the privatization process began in 2003.

montage designs by Greg Smith)

—-Post-flight

During the 2005-2009 period, EL AL built upon the major upgrade it made in 2004 to its frequent flyer program called ‘Matmid’. It increased opportunities for earning and using frequent flyer points, including expanded relationships with credit card companies, hotels, rental cars, and other airlines and businesses. Special bonus point offers were made frequently to attract and retain frequent flyers, and Matmid club membership significantly expanded.

In an annual survey by noted Israeli newspaper Yediot Ahronot, conducted in 2007, EL AL was ranked as the leading brand in Israel, and in providing the best service, and the best frequent flyer program, of all airlines flying to and from Israel.

Passenger Routes — The Point-to-Point Airline

In July 2006, on its Tel Aviv to Los Angeles route, EL AL eliminated its stopover in Toronto, Canada, thereby reinstating nonstop service to Los Angeles. Since then EL AL has operated only nonstop passenger service system-wide, making it one of the largest all ‘point-to-point’ airlines in the world.

During the 2005 – 2009 period EL AL continued regularly scheduled passenger service to about 36 to 40 destinations. Management focused its attention on enhancing existing routes by adding flight frequencies rather than starting service to additional points. It determined that more flights per week to a given destination increase the airline’s attractiveness, particularly to business travelers, when compared to others serving the same route. Accordingly, frequency increased to such destinations as New York, Los Angeles, Toronto, Mumbai and Hong Kong.

The only significant new destination during this period was Sao Paulo, Brazil, initiated in May 2009 – EL AL’s first service to South America. Flights to London’s Heathrow Airport were also supplemented by flights starting May 2009 to West London’s Luton Airport.

On the other hand, during this period EL AL, following a review of the economic feasibility of certain of its routes, halted flights to Larnaca, Cyprus and Istanbul, Turkey (March 2007); Chicago (April 2007) and Miami (September 2008). In each case the reason given was lack of economic feasibility, including as to Istanbul exceptionally high security costs. In the case of Miami, due to high fuel prices at the time, the route was said to be uneconomical to operate even with a full planeload of passengers.

EL AL also continued during this period to operate flights through its wholly-owned subsidiary Sun d’Or. Most of these flights were charters carried out by providing aircraft capacity to organizers of charter flights at prices agreed in advance, and the sale of blocks of seats to agents. Sun d’Or’s charter flights are typically to holiday destinations and are operated with EL AL aircraft, usually 757s during this period, but with Sun d’Or markings. Starting in 2008 Sun d’Or (along with Israeli carriers Arkia and Israir) acquired rights to operate scheduled flights to selected destinations approved by the Israeli government.

To promote marketing and connectivity to other destinations, EL AL continued to maintain ‘code-share’ agreements with several foreign airlines. These permit an air carrier to market flights of another air carrier to specific destinations, as if they were its own flights. For example, in December 2007 EL AL signed a code-share agreement with American Airlines which gave EL AL’s passengers the possibility of continuing flights to over 20 major destinations of American Airlines throughout the U.S.

Competition

Although EL AL became fully privatized in 2005 and no longer state-controlled, it remains subject to State-determined aviation policies and agreements that affect not only operations, but also competition with other airlines. Some of the main elements that affect EL AL’s ability to compete following its privatization include:

1. Liberalization of Israel’s civil aviation policy (‘Open Skies’) — including agreements between the State of Israel and other countries determining which airlines can fly on specified international routes and their frequencies and capacity.

2. ‘Designated Carrier’ Status — extent to which EL AL or other Israeli airlines are appointed by the State of Israel as a ‘Designated Carrier’ on a specific route.

3. Security Costs — extent to which the State of Israel shares in the security costs incurred by Israeli airlines, which proportionately are far higher than what airlines of other countries spend for security.

1. Liberalization of Israel’s Civil Aviation Policy — ‘Open Skies’.

Operating a scheduled flight from one country to another requires an agreement of both countries, known as a bilateral aviation agreement. Under such agreements, each country is typically permitted to appoint one airline, or less commonly a limited number of airlines, to be their ‘Designated Carrier’ on flights between the two countries concerned. The agreements also usually regulate the frequency and capacity of flights.

At the beginning of 2006, the Israeli government started to implement a policy of growing liberalization in the aviation industry, to increase tourist travel to Israel by promoting more competition between airlines. Initially, the Civil Aviation Authority approved individual requests by many airlines, especially from Europe, to increase their supply of seats to Israel by adding frequencies or by operating larger aircraft. Then the Israeli government signed new bilateral aviation agreements with 12 countries that provided for multiple Designated Carriers for each side and increased flight frequencies. As a result, many airlines already flying to Israel increased the frequency and aircraft size of their flights to Israel and, from 2007 to 2009 alone, 19 airlines started flying to Israel that had never flown regular scheduled flights there before.

In addition, the Israeli Ministry of Transport appointed a public committee to evaluate a more liberal policy called ‘Open Skies’. The committee submitted its report in April 2007. It recommended an aviation policy that would stimulate economic growth and increase tourism to and from Israel, while adapting to the global economic environment. Towards that goal it recommended the signing of liberal agreements that remove limitations relating to capacity, destinations, frequency and number of Designated Carriers. As an initial step, the committee recommended immediately opening negotiations with representatives of the European Union (‘EU’) countries, in order to institute, gradually within three years, an ‘Open Skies’ policy with those countries.

In November 2007, discussions began between Israel and the EU aimed at eliminating the need for separate agreements with each European country, and the implementation of one uniform global aviation agreement between the EU (representing its member European countries) and Israel.

In December 2008, as an interim step, Israel and the EU signed a new aviation agreement that updated sections of the bilateral aviation agreements between Israel and individual EU member countries relating to the ownership and control of Designated Carriers. Moreover, it allowed airlines controlled and owned in any EU member-country to operate scheduled flights to Israel from any other country in the EU, subject to the bilateral agreement concerned. (For example, an Austrian-controlled airline could now operate flights from Slovakia to Israel, subject to the aviation agreement between Israel and Slovakia).

During the years 2006 – 2010, the seat availability of foreign airlines at Ben-Gurion Airport increased by 90% — almost a doubling of capacity. These airlines increased their passenger numbers not only between their home airports and Israel, they utilized their home airports as hubs to greatly increase the number of destinations on flights to and from Tel Aviv via connecting flights, taking advantage of their route networks and those of their partners in global airline alliances and code sharing agreements. The liberalization of Israel’s aviation policy carried over to charter flights as well. Israel adopted a more liberal policy of granting authorizations to airlines, both foreign and Israeli, to operate charter flights to and from Israel. In all, incoming foreign tourists to Israel through Ben-Gurion Airport increased from 1.7 million in 2005 to 2.1 million in 2009. During this period the corresponding number of Israelis travelling abroad via Ben-Gurion Airport increased from 3 million to 3.4 million.

While the increase in tourism to Israel was very welcome, the means adopted by the Israeli government in effect placed EL AL at a significant competitive disadvantage compared to foreign airlines. This was due to Israel’s geopolitical situation, including the Arab Boycott. Most Arab and Muslim countries near Israel, such as Saudi Arabia, the Gulf States, Syria, Iraq and Iran did not allow EL AL to fly over or into their territory. As a result, all of EL AL’s flights to the Far East, such as to China, India, Thailand and Hong Kong, had to take circuitous routes to avoid those boycotting countries. To fly to India or Thailand EL AL had to first fly south along the Red Sea towards Ethopia and then east, while to China or Hong Kong it had to fly north over Turkey and then east through Russia and Kazakhstan. This added as much as 50% more time to a flight plus the cost of added fuel, thereby making the flights relatively less desirable and more costly than the competition.

Moreover, while EL AL’s main competitors have been able to enjoy the significant benefits of participating in global airline alliances and the development of home base airport hubs for connecting flights, the geopolitical and security situation of Israel has in effect prevented EL AL from taking advantage of similar benefits. The Arab Boycott impeded Ben-Gurion Airport from developing into a competitive hub for EL AL to utilize for connecting flights. Also, joining one of the three main global airline alliances presents security and connectivity concerns for EL AL, particularly where some of the participating airlines are from countries that boycott or do not have diplomatic or friendly relations with Israel.

2. Designated Carrier Competition. After completion of EL AL’s privatization in 2005, the airline soon faced not only greater competition from foreign carriers, but also increased international competition from Israel’s two other main airlines, Arkia and Israir. Shortly before the initial public sale of EL AL shares of stock in May 2003, the Israeli government issued certain aviation policy decisions, detailed in the prospectus for the stock sale, binding it and the airline. These decisions contained both protections and restrictions affecting EL AL and were established only after extensive negotiations with the government regarding EL AL’s rights and obligations upon privatization—all designed as a package for the strategic interest of Israel and the overall benefit of the country’s aviation industry.

One of these decisions stated that, subject to specific conditions, EL AL would continue as the sole designated national air carrier of Israel on its then-existing scheduled routes. The understanding added that the government could re-examine the situation and grant additional designated national air carrier rights to one or more other Israeli airlines (such as Arkia or Israir) on the same route, if it finds that EL AL’s market share falls below 30% of annual scheduled passenger traffic on the route concerned, or that the total annual passenger traffic to and from Israel rises above 10.7 million (it was under four million in 2003, the year of such decision).

The Israeli government, however, soon took the position that it had the right to unilaterally change the terms of that protective clause and could appoint any number of Israeli Designated Carriers on any existing or future route. In January 2006 the Minister of Tourism appointed Israir as another Designated Carrier, initially for two years, on the flagship Tel Aviv–New York route. EL AL, its parent company Knafaim and representatives of EL AL’s employees objected, emphasizing that the conditions for considering another Israeli carrier on the route (reduced market share on the route or rise in annual passenger traffic to and from Israel) were not met. However, the Government insisted it had the right to change those conditions.

In January 2008 the Israeli Government, citing its new policy of liberalizing aviation, formally revoked the above-described Designated Carrier threshold protections for EL AL that had been established in 2003. At the same time, recognizing the need to allow Israeli airlines ‘to contend, to the degree possible, in fair and equal competition, opposite foreign airlines’, the Government called for increasing the percentage of the State’s participation in the burden of security expenses of Israeli airlines from 50% to 80%.

Accordingly, Israel’s Minister of Transportation started appointing Arkia and Israir as additional Designated Carriers for regular scheduled service on numerous international routes including — for example in 2008-2009 on routes served by EL AL — Arkia to Barcelona, Madrid, Moscow, Munich and Paris, and Israir to Berlin, London, Milan and Rome. At the same time it appointed EL AL’s subsidiary, Sun d’Or, as a Designated Carrier for scheduled service to Antalya, Bratislava, Dusseldorf, Frankfurt, Rostov, Sochi and Zagreb. However, the increase in the Government’s participation in security costs was not immediately implemented. (see point 3 below).

3. Security Costs.

Until the early 1980s, the State of Israel covered all of EL AL’s security costs, but thereafter the State adopted a policy of reducing the rate of its participation in security expenses, until in 2001 the State paid as little as 25%. Starting in 2003, when the process of privatizing EL AL began, the State raised its participation to 50%.

EL AL is widely recognized for its extraordinary security protections, necessitated in part by the geopolitical situation of the State of Israel. However, this security entails staggering costs, far higher than those borne by foreign airlines, thereby affecting EL AL’s competitive position. For example, in 2008 alone, the direct costs of security of EL AL’s passengers, aircraft and employees were over $96 million, and in 2009 they were over $107 million. In addition, EL AL incurs indirect security costs by flying security marshals in seats that could have been sold to paying passengers.

In 2008, when the State revoked EL AL’s Designated Carrier protections, it resolved in return to increase the State’s participation in EL AL’s direct security expenses from 50% to 80%. This was to assist EL AL to maintain a fair and equal competitive position against foreign airlines while the liberalization of ‘Open Skies’ occurred.

Nevertheless, the increase to 80% was not implemented right away. EL AL brought suit and, while the suit was pending, the State agreed in 2009 to raise its participation in security expenses to 60% and, upon the signing of a global aviation agreement (‘Open Skies’) with the European Union, to 75%.

Not until 2011 did the State agree to gradually increase its share of security expenses of EL AL (and other Israeli airlines) from 60% to 65% in 2011, 70% in 2012, 75% upon signing of a global aviation agreement (‘Open Skies’) with the European Union, and finally 80% upon implementation of an Open Skies agreement with the EU.

Cargo

During the first three years of EL AL’s privatization, 2005-2007, the use of dedicated all-cargo aircraft continued to be important for EL AL. It operated a fleet of four 747-200 freighters (4X-AXF/K/L/M), with scheduled service from Tel Aviv to Amsterdam, Liège, London and Luxembourg in Europe; Alma Ata in Kazakhstan; New York; and Mumbai, Seoul and Shanghai in Asia. In each of these years EL AL transported over 150,000 tons of cargo. The Cargo division has long been well-known for its ability to handle unusual or difficult loads, including extremely heavy or large equipment or pipes; valuable or rare animals; and delicate or sensitive items, such as miniature electronics.

Until 1999 EL AL was the sole designated cargo carrier of Israel. That year, however, the Israeli freight airline C.A.L. (Cargo Air Lines) obtained a license to operate freight service from and to Israel without having to lease aircraft from EL AL (as it had previously been required to do), and since then it has been a direct competitor. Moreover, several overseas airlines introduced larger passenger aircraft, such as Boeing 777s, and increased their frequencies, to Israel, using the extensive belly space in these larger aircraft to carry freight. These factors led to an overall slow but continuing decline in the revenue of EL AL’s Cargo division.

To compete, EL AL Cargo implemented an ‘Active Service’ plan aimed at giving the fastest, most efficient service to customers, and at more competitive rates. Flight schedules were conformed as much as possible to the seasonality of traffic and to preserve schedule stability. Frequencies increased to the most popular destinations, as well as between those destinations, such as between Luxembourg and Shanghai.

Nevertheless, the increased competition mentioned above and the worldwide economic recession of 2008 – 2009 significantly impacted EL AL’s cargo traffic. Cargo carried by EL AL fell to 87,300 tons in 2009, a decrease of about 40% from 2007, and the lowest in 25 years. Accordingy, EL AL retired two of its 747-200 freighters (4X-AXF and AXM) in 2008.; and the remaining two 747-200 freighters (4X-AXK and AXL), because of their advanced age and high maintenance requirements, became scheduled for near term withdrawal, with possible replacement by one or two 747-400 freighters.

The Wild Ride of Profits and Losses Under Privatization

The first five years of EL AL’s completed privatization witnessed increased financial pressure on the airline. Earlier in this chapter we described the more liberal global aviation policy adopted by the Israeli government which promoted sharply increasing competition from foreign and other Israeli airlines; and the prolonged negotiations between EL AL and the government over the extent to which the State of Israel would share in the extraordinarily high security costs that Israeli airlines had to incur (averaging for EL AL over $100 million per year). EL AL took numerous steps through its five-year strategic plan, also described above, to counter these developments.

However, even more issues arose that made the road to profitability a rocky one.

— Spiraling Fuel Prices

Jet-fuel costs for an airline are typically the largest single operating expense item — by far. During 2005 – 2009 jet-fuel costs averaged between 31% and 36% of EL AL’s total operating expenses.

2005 saw the start of a sharp upward spiral in jet-fuel market prices, rising 44% in 2005, another 15% in 2006, yet another 18% in 2007 and finally another average 43% increase in 2008. Crude oil rose to a record $145 per barrel in July 2008, and EL AL’s jet-fuel costs that year were $771.2 million – double that of 2005. Although fuel surcharges on ticket prices occurred during these years, they only covered a small portion of the increased fuel prices.

The upward spiral of fuel costs started to abate at the end of 2008, but that was due to another serious problem – a worldwide recession began.

— Global Financial Crisis

In late 2008 and 2009 worldwide economies suffered from a financial recession. This caused a significant drop in passenger travel by air, particularly in the business sector, and a sharp drop in cargo traffic. Although jet fuel prices dropped, this was not enough to offset the traffic decline, and airlines around the world suffered material losses.

At Tel Aviv’s Ben-Gurion Airport, EL AL’s home base, international passenger traffic in 2009 dropped 5%, and cargo handling plummeted 16%, compared to 2008. Charter flight passengers at BGA decreased 27%. On regular scheduled flights through BGA, although passenger numbers increased 1%, the seats offered by all scheduled airlines at BGA increased 5%, adding downward pressure to ticket prices just to fill seats.

— Terrorism Leads to War.

During July-August 2006, the Hezbollah military in Lebanon launched rocket attacks against Israel, resulting in a war that eventually saw over 4,000 rockets fired at Israel. This materially impacted tourism and passenger traffic to and from Israel, and accordingly EL AL suffered financially from the consequences. Similarly, incessant rocket attacks by Hamas military in Gaza against Israel led to the Gaza War (Operation Cast Lead) from the end of December 2008 to mid-January 2009, and substantially impaired air traffic with Israel during the first half of 2009. In each case EL AL again proved to be the only airline serving Israel internationally during these hostilities, but nevertheless it had to absorb a big financial hit.

— Profits and Losses

As a result of all the sharply increased competition and the other factors described above, the year-to-year profitability of EL AL varied greatly during 2005 to 2009, the first five years of its complete privatization. Matters started off well with a $64 million net profit in 2005, the highest in EL AL’s history. After that, however, 2006 saw a loss of $45 million. While 2007 swung back to a profit of $45 million, 2008 and 2009 experienced losses of $42 million and $76 million respectively.

Summary of First Five Years of Complete Privatization

As detailed above, upon EL AL becoming completely privatized at the beginning of 2005, the Israeli Government soon started to implement a new liberal aviation policy, aimed at encouraging more competition among EL AL, other Israeli airlines, and foreign airlines, with the ultimate goal of stimulating more tourist travel to Israel.

EL AL countered with a five-year strategic plan that produced many improvements. It upgraded its fleet with two more new 777s, seven more 737-800 New Generation aircraft, and two more 747-400s and 767-300s. New improved seats were installed on its aircraft. Reservations and internet technology greatly advanced, flight frequencies on its main routes increased, and in-flight entertainment options and service were enhanced. During this period EL AL’s passenger flight segments and revenues increased over 18%, and its seat occupancy on passenger flights rose from 76.9% to 81%.

Nevertheless, these improvements were not enough to offset the increased competition of other airlines and the limitations on EL AL due to Israel’s geopolitical situation. By 2009 about 100 airlines were competing with EL AL on flights to and from Israel, and they competed with more frequencies and often increasing their aircraft size on the Tel Aviv route, and benefiting from strategic connections at their home base airline hubs and from global alliances. Moreover, EL AL had to continue incurring far higher security costs than other airlines, it faced difficulties in trying to join a global airline alliance, and its routes to the East confronted higher costs due to boycotting Arab and Muslim countries that did not allow Israeli airlines to fly over their airspace. As a result, EL AL’s market share of passenger traffic at Ben-Gurion Airport fell from 43.3% in 2004 to 37.5% in 2009. The next decade would test EL AL’s capability to confront and overcome these challenges.

Management Changes

On 31 December 2008 Prof. Israel (‘Izzy’) Borovich stepped down as Chairman of the Board of EL AL while remaining as a member of the Board; and on 21 February 2009 Amikam Cohen, previously president of Partner (Orange), a leading telecommunications company in Israel, was appointed as the new Chairman.

On 31 December 2009 Haim Romano left the position of President of EL AL after five years of service, marking a transition after the first five years of EL AL’s complete privatization. On 1 January 2010, Elyezer Shkedy, previously Commander-in-Chief of the Israel Air Force, was appointed EL AL’s new President, thereby opening the next chapter in EL AL’s battle with its increasingly competitive environment.

Published 30 October 2020.

Copyright 2020, Marvin G. Goldman